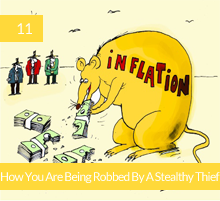

Keith discusses the inefficiency of compound interest in wealth building, advocating for compound leverage through real estate investments. He illustrates how a $100,000 investment in a $500,000 property at a 6% annual return can yield much higher returns due to leverage (see the math below).

He also explains how mortgage rates are influenced by long-term bond yields and discusses the benefits of real estate over stocks.

A coaching call with GRE Investment Coach Naresh highlights the process of investing in real estate, including financing considerations and the role of a coach in guiding investors.

Here’s the math on a 5:1 leveraged RE return at a 6% appreciation rate:

Year One: $500,000 x 1.06 = $530,000. Subtract $400K debt = $130,000 equity

Year Two: $530,000 x 1.06 = $561,800. Subtract $400K debt = $161,800 equity

Year Three: $561,800 x 1.06 = $595,508. Subtract $400K debt = $195,508 equity.

GRE Free Investment Coaching:

Show Notes:

For access to properties or free help with a

GRE Investment Coach, start here:

Get mortgage loans for investment property:

RidgeLendingGroup.com or call 855-74-RIDGE

or e-mail: info@RidgeLendingGroup.com

Invest with Freedom Family Investments.

You get paid first: Text FAMILY to 66866

For advertising inquiries, visit:

Will you please leave a review for the show? I’d be grateful. Search “how to leave an Apple Podcasts review”

Best Financial Education:

Get our wealth-building newsletter free—

text ‘GRE’ to 66866

Our YouTube Channel:

www.youtube.com/c/GetRichEducation

Follow us on Instagram:

571: Trump’s Takeover of the Fed Will Unleash a Wealth Bonanza and a Dollar Crash with Richard Duncan

569: Star of A&E’s “The Real Estate Commission”: Todd Drowlette on Big Deals, Big Drama & Bigger Negotiations

566: Your Listener Questions – Bonus Depreciation, Realtor Fee Changes, Down Payments, Outrageous Inflation

563: Are College Towns Doomed? Housing Supply Grows, More Apartment Loan Implosions with Hannah Hammond

553: “Tariffs Will Create Empty Shelves and Economic Disaster” -Father of Reaganomics, David Stockman Joins Us

521: Terrible Predictions, “End the Fed” and Capitalism with Mises Institute President Dr. Thomas DiLorenzo

512: Rent Control is a Bad Plan, Own Land in a New Micronation with Liberland President Vit Jedlicka

464: Avid GRE Listener Buys 11 Rental Properties in 4 Years. Here’s What Happened, with Shawn Finnegan

445: Your Questions Answered: Overleveraged, House Hack vs. Turnkey, Hyperinflation, With Keith Weinhold

411: What Does Life Want From You? Rentflation, Housing Market Normalizes, Available Properties, With Naresh Vissa

316: Why The Housing Crisis Will Worsen – Keith’s Prediction, Guaranteed Rent Income with GRE’s Aundrea Newbern