When the latest inflation number was reported at 8.5% last week, it’s remarkable that it represents a drop in the level of inflation.

If you would have seen that sentence a couple years ago, you’d have trouble believing your eyes.

Many economists expect that high inflation could persist this entire decade.

You’ve seemingly heard of all of inflation’s derivative forms by now—shrinkflation, reflation, skimpflation, disinflation, hyperinflation, stagflation, and even heatflation.

What about “rent-flation“?

Here are some real life rent increases that my property manager just achieved on four of my rental single-family properties:

- $1,150 → $1,225 (7%)

- $1,350 → $1,475 (9%)

- $1,350 → $1,550 (15%)

- $1,275 → $1,500 (18%)

These increases occurred with tenants that accepted the raise and continue to reside there. Larger rent increases can often be achieved between tenancies.

Inflation is an economic malady to many, including your tenants.

As real estate investors, we know that rent increases are just one of the three ways inflation benefits us simultaneously.

I bought all four of these properties at the same place that you can. Just copy what I do—create one login, one time, and connect with all property providers at: GRE Marketplace.

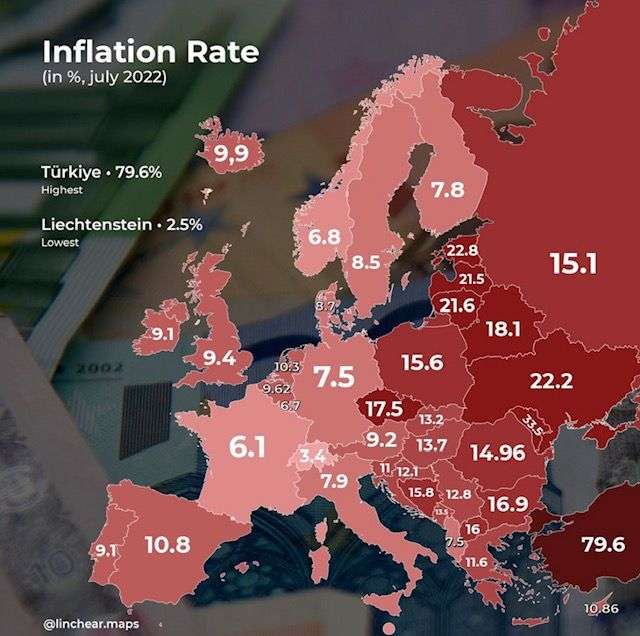

Inflation… it’s not just a North American thing:

Thought getting your money to work for you creates wealth? It doesn’t! That’s a myth. My one-hour investing video course is now 100% free: Real Estate Pays 5 Ways. For a limited time, you can learn how wealth is really created, here.