One key to designing an aspirational lifestyle for yourself is: “Don’t live below your means—grow your means.”

For some elucidation, increasing your income deserves focus because it’s unlimited.

Conversely, you can only reduce your expenses a finite amount… and it often lowers your quality of life. In a world of abundance, austerity is not sexy.

“I made my millions by brewing my own coffee at home.” -said no one, ever.

That’s why we focus on wins around here.

“All (we) do is win, win, win, no matter what.” -DJ Khaled with T-Pain. Again, I outsource the rapping to others.

It’s still worth reducing unnecessary expenses in your rental properties.

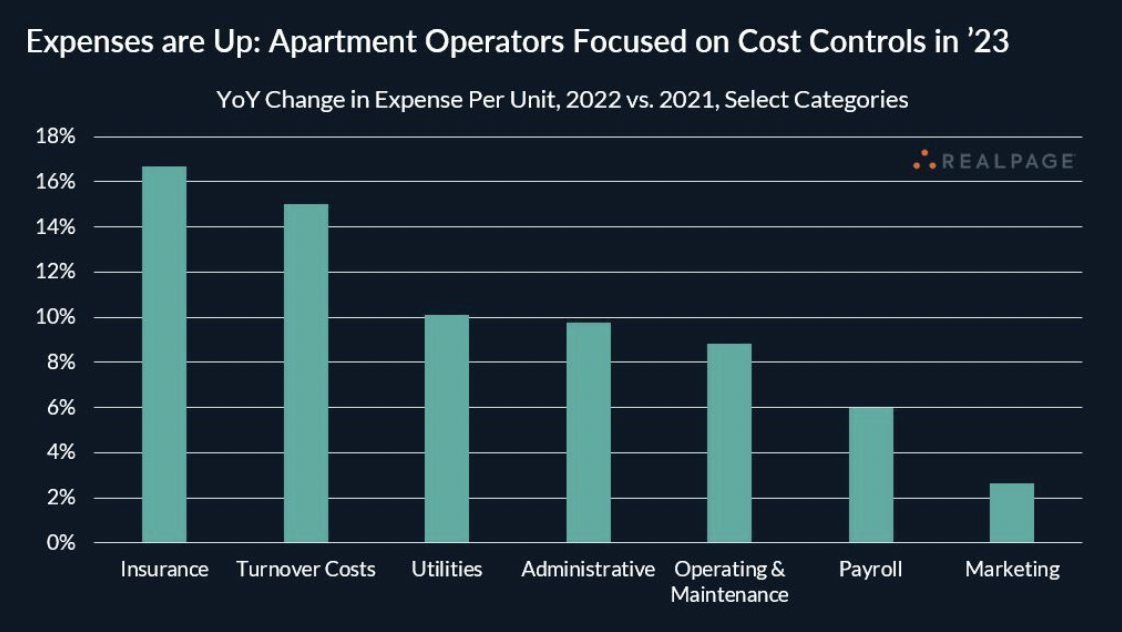

Here’s some real estate bad news—rising property expenses.

They’re led by insurance costs, which have erupted like Mauna Loa 17% year-over-year:

Turnover costs are 15% higher. Turnover costs essentially combine higher costs for both materials and labor.

Property taxes were only up 4% nationally last year.

Even in a volcanic property expense eruption, you can avoid getting burned by lava.

Real estate moves more slowly than the volatile markets of stocks, bonds, commodities, derivatives, and crypto. You can get out of harm’s way and you’ve got more control.

Here’s how to handle rising property expenses:

- Raise the rent gradually with existing tenants, try more sharply with new tenants

- Focus on tenant retention

- Shop around for insurance

- For new tenants, add a clause in your lease that tenants pay for the first $200 in repairs per occurrence. (I see more PMs doing this.)

- Be sure to get tax deductions for all eligible expenses

- Get at least 3 contractor bids for major work items

Or just ask ChatGPT what to do? Maybe not.

Raising the rent and retaining tenants seems contradictory. But my explainer video tells you how to do both at the same time.

Of course, on an inflation-adjusted basis, some of these expense increases aren’t much of a real rise at all.

The torrid rent growth we’ve seen over the last two years has probably given you more than enough cover.

OLDEST TURNKEY PROVIDER

Investors line up for their properties like it’s the latest iPhone. Did you bring along a tent and some Clif bars?

Not only are they America’s longest-running turnkey real estate provider (*as far as we know)…

… but Mid South Home Buyers is also the first provider ever featured on GRE, way back in Episode 9, in 2014.

They make ugly houses pretty.

They only deal with properties that they would own long-term themselves.

GRE followers have bought their 1st, 2nd, 5th, and even 9th properties with them for their impeccable service and impressive cash flows.

Offering all-done-for-you income property in Memphis and Little Rock, they’re our guest on this week’s show again.

Of course, I’ve visited their offices, warehouse, and properties in-person with the principals. Learn more or get started here.

They’ve nearly become as well-known as other “operations” from Memphis, like: Elvis Presley, Justin Timberlake and Morgan Freeman.

Yeah, but those guys didn’t know how to produce real estate cash flow.

What about their prices and rents?

- $95K-$160K Memphis Rehab SFRs → Rent $780-$1,400

- $110K-$170K Little Rock Rehab SFRs → Rent $850-$1,500

- About $190K Little Rock New SFRs → Rent $1,300-$1,400

- $180K-$220K Memphis Rehab Duplexes are sometimes available

The average tenant duration is four years.

What’s my “take” compared to other markets? High cash flow, modest appreciation, low price, low risk, and an outstanding operator and property manager.

They’re so proud of what they do that they offer monthly bus tours. Tour attendees get a $500 credit if they choose to purchase.

Thought getting your money to work for you creates wealth? It doesn’t! That’s a myth. My one-hour investing video course is now 100% free: Real Estate Pays 5 Ways. For a limited time, you can learn how wealth is really created, here.