Real estate investors, economists, and businesses all care deeply about American job growth.

Your tenant needs a job to pay the rent.

After a robust GDP reading, the latest BLS Jobs Report added insult to injury for all the perma-crash bros that stoke fear in blogs, on podcasts, and on YouTube.

The whopping 517,000 new jobs added last month nearly tripled expectations.

Still… I wonder if constant rumors about a coming recession will drag on longer than the fake meat fad.

Gettin’ wonky on ya already? Yep.

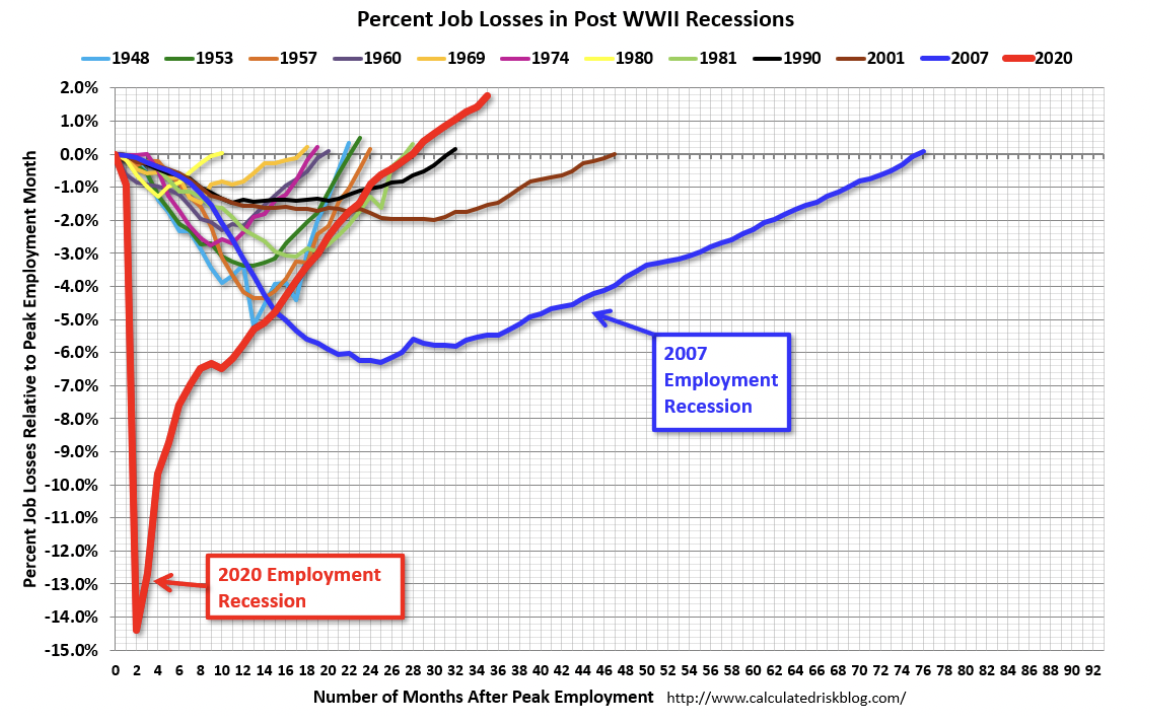

This awesome chart shows the beautifully historic context on how the American economy has roared back since the start of the pandemic compared to prior recessions:

Note the red line’s trough. It represents the deepest job losses from the pandemic shutdown in 2020.

What happened back then? Goods weren’t being produced; services were severely limited.

When more stimulus-fueled dollars began chasing fewer produced goods, that’s exactly what stoked the inflation fire that we’re still feeling today.

I’ve actually become accustomed to paying $8 for a bottle of Bragg salad dressing by now. But in today’s polite society, I’m still not tipping 25% on $6 bottled water.

Though more jobs are good news, it’s not all good.

The bad news is that strong employment means more inflationary pressure. Jerome Powell said that Americans should expect “a couple more rate hikes”.

What’s the reason for all this job creation?

It’s American innovation.

People have falsely believed that innovation destroys jobs since before the tractor replaced horses and mules, meaning that it took fewer farmers to feed the animals.

Today, innovation is making bank tellers and grocery store cashiers vanish.

Innovation creates jobs.

Exhibit A: In 2023, we’re more technologically advanced than at any time in human history.

Result? We have 11 million more jobs than available workers. It’s the opposite of unemployment.

Twenty years ago, few could have foreseen today’s new job opportunities as a…

… drone operator, quantum machine learning analyst, YouTube creator (hey, guess I heard that!), social media director, app developer, information security analyst, digital marketer, TikToker, metaverse wearables developer, and on and on.

Even a “digital yard sale” company like eBay just announced new hires for Web3 and NFTs—fields that barely existed two years ago.

When self-driving cars replace Uber drivers, those jobs will simply migrate to better-and-higher uses, just like it did for yesterday’s telephone switch operators, travel agents, bowling pin boys, and elevator lift attendants.

But people will still fear for the “loss of jobs”.

OK. Well… so what?

What if gloomer-and-doomers discount American innovation and plow ahead with more fear-mongering headlines like: “giant crash ahead”, “total market collapse” or “massive depression coming”?

How does that really hurt anyone?

Like… who cares?

It matters because it keeps us living in fear. Humans have two million year-old brains, adapted for survival. We seek out threats.

Our brain’s amygdala is wired to be stimulated by danger, alerting our nervous system.

Overconsumption of fear-mongering media can make you live a small life by, say:

- Keeping your money in a “safe” savings account that yields half of the inflation rate. Supersavers move toward poverty.

- Spurning new business investment.

- Avoid living the expansionary life that you truly want for yourself, like starting an alpaca farm, having children, chartering a yacht in Ibiza or rafting the Grand Canyon.

Has that dreary material even made you want to… quit your daydream?

You’ll never get that lost time back.

Permabears rarely admit that their dire predictions were wrong. They’ll just go on making more intransigent apocalyptic forecasts to get clicks.

People have been predicting the end of the world since… the beginning of the world.

If you constantly call on a recession, you’ll usually be wrong. Yet you’ll eventually be correct since they occur every five years, on average.

Here at GRE, it’s both good and bad news.

It’s history over hunches, acting over waiting, and accuracy over hyperbole.

Thought getting your money to work for you creates wealth? It doesn’t! That’s a myth. My one-hour investing video course is now 100% free: Real Estate Pays 5 Ways. For a limited time, you can learn how wealth is really created, here.