US real estate owners get to have their cake and eat it too. And I’ve always wondered, what’s the point of having cake if you can’t eat it?

In Canada, most borrowers’ mortgage rates reset every five years.

Sheesh, can you imagine your monthly mortgage payment doubling or tripling overnight? It’s most people’s biggest payment.

In the UK, it’s worse. Most of their mortgage rates reset every two or five years. By 2023, 2.4 million mortgage rates expire for Brits. I guess they’ll settle for a scone rather than cake.

Australia, Spain, Ireland, and South Korea are all dominated by ARMs with a short-term initial fixed rate.

Germany and France have longer-term fixed rates but often come with pre-payment penalties.

Worldwide, the US is almost exclusively unique for its high proportion of long-term fixed rates with zero pre-payment penalties.

Foreigners can’t believe how good we have it. Sometimes, they’re incredulous that we don’t borrow more.

Therefore, how should Americans play their existing mortgage loan cards?

- When rates rise → Stay put. Your rate will soon feel low compared to others.

- When rates fall → Refinance. Enjoy your extra cash flow. You could even pull out cash at the same time, tax-free.

In much of the world, the lender resets your terms. But in the US, you decide if and when to reset your mortgage. To foreigners, this advantage almost feels illegal. Of course, it’s entirely legal.

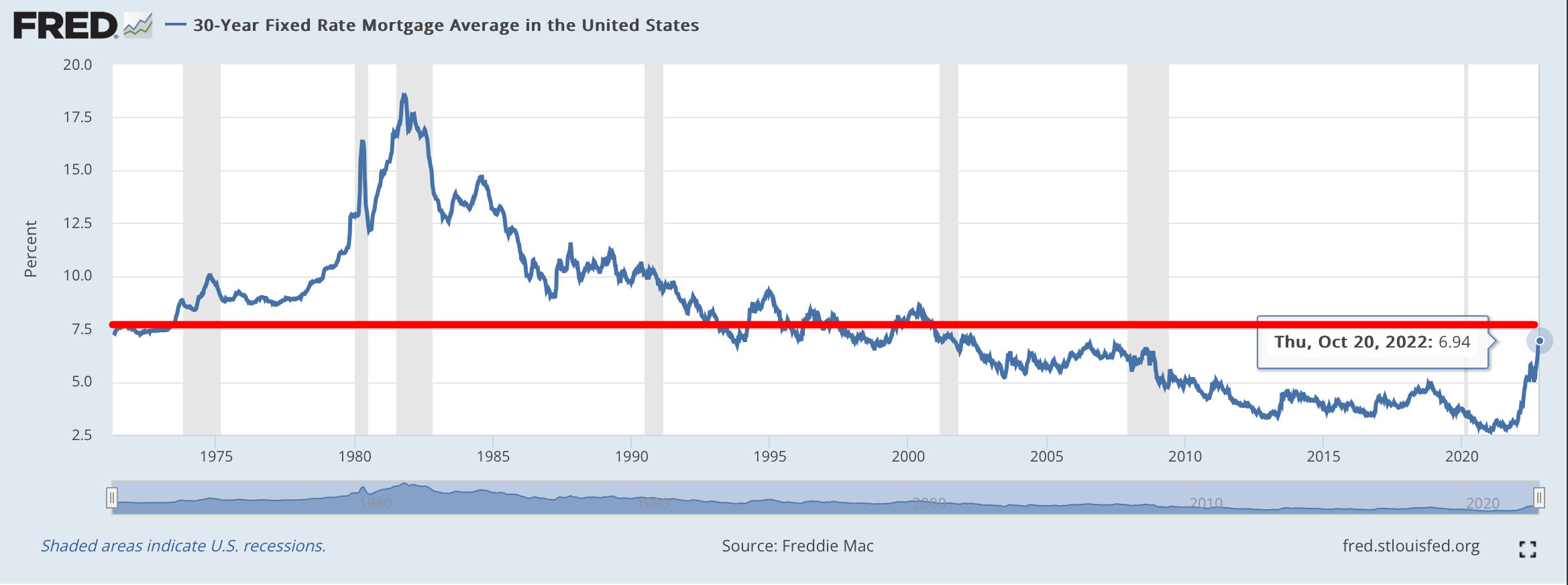

Though it may not feel like it, at 6.94% today, US mortgage rates are still below their historic average of 7.76%.

Amidst the Fed’s rate hike-a-palooza, many expect them to be between 8% and 9% by year-end.

This has spooked primary residence buyers. But it’s creating a windfall to us as rental property owners. It places more people in the rental pool and makes rents surge.

In hot markets, prospective tenants are even offering gifts to landlords. Maybe a cake?

I’ve gotta say though… I’m a little envious of Japan and Switzerland. They have an intergenerational mortgage option. It’s a 100-year repayment period.

Like I say, Financially-Free Beats Debt-Free™.

Thought getting your money to work for you creates wealth? It doesn’t! That’s a myth. My one-hour investing video course is now 100% free: Real Estate Pays 5 Ways. For a limited time, you can learn how wealth is really created, here.