I recently learned about an announcement by a leading national investment property lender. Their new mortgage loan product allows you to have:

- No Job

- No Income

My first thought was: “Oh no. Are we reverting back to the ~2005 era of irresponsible lending practices?”

Here’s a quick, tragic mortgage history lesson.

NINJA loans, as critics called them, helped crash the housing market from 2007-2009. NINJA stands for “No Income, No Job, or Assets”.

These ninjas didn’t wield nunchucks and hurl throwing stars. They were even more deadly.

Back then, it seemed like everyone made the same joke: “All that you have to do is be able to fog a mirror in order to get a mortgage loan.”

Anyone and everyone qualified.

Fifteen years ago, when underqualified (called “subprime”) borrowers had their low teaser rates reset, they couldn’t afford the higher payments.

Negatively amortizing loans led to slumping equity positions.

Loans originated at 90-100% LTV meant that borrowers soon had zero skin in the game or were underwater – mortgage debt exceeded the home value. It was easy for borrowers to walk away.

There was a glut of housing supply on the market too.

It was awful. Borrowers often lost their home or had their credit ruined. Real estate values tanked nationally. Banks foreclosed at a loss.

Those mortgages were as legit as whatever is inside a Hot Pocket. They were for primary residences, which don’t generate income.

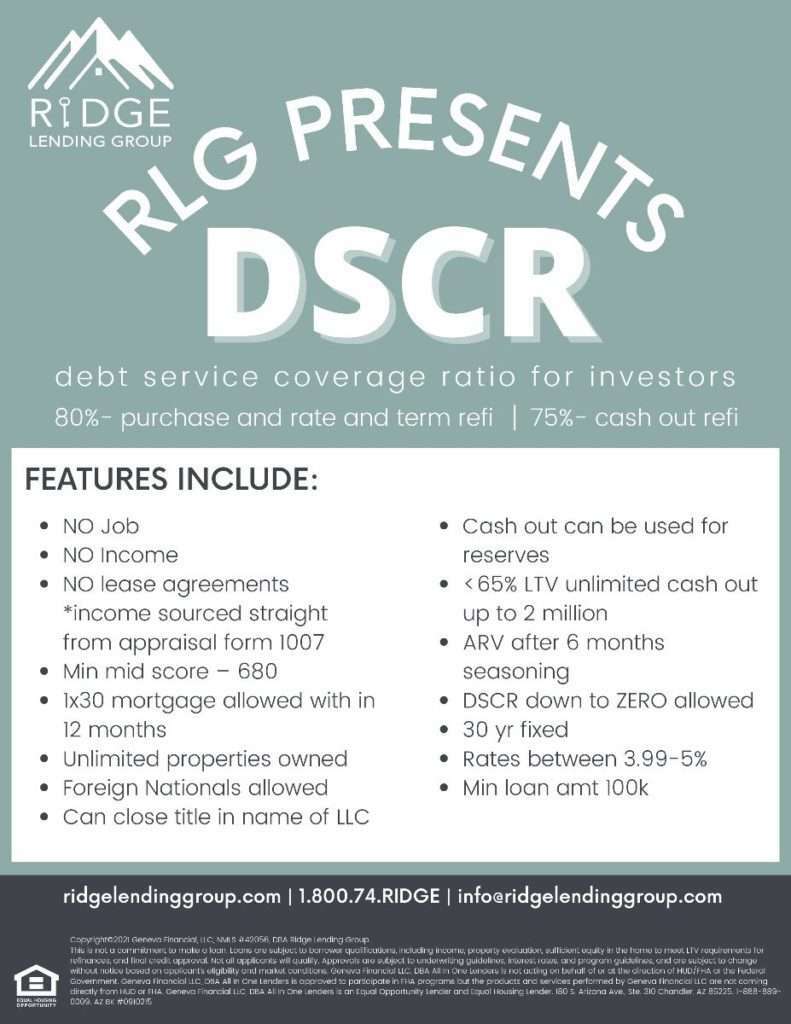

However, the new announcement (below) is for income property.

You might know that in the world of 5+ unit apartments, lenders qualify based on the performance of the property more so than the borrower.

Now this product has become more prevalent in the 1-4 unit investment property world.

It is underwritten like a commercial apartment loan and is asset-based:

“DSCR” is a term from the 5+ unit apartment lending world, meaning “Debt Service Coverage Ratio”.

Example: $1,200 gross rent divided by $1,000 proposed Principal, Interest, Tax & Insurance = 1.2 DSCR.

Again, note that there’s nothing about you in this calculation. It’s about qualifying the property.

Despite that fourth-to-last bullet point in the announcement above, you likely won’t get funding below a 1.0 DSCR.

1.5+ means you’ll likely get a lower interest rate.

Back to the NINJA acronym, cut out the “no” (N) parts. The income (I) and job (J) essentially come from your tenants.

This provides some remarkable flexibility. You have the ability to qualify for a virtually unlimited number of properties.

There’s no 10 single / 20 married maximum financed properties like with Fannie Mae and Freddie Mac.

Foreign nationals are allowed.

For those that previously had trouble meeting the personal debt-to-income (DTI) ratio threshold, now you’ve got a new option.

High net worth individuals and others with low DTIs have also preferred this loan because there is less documentation required than “full Fannie-Freddies”. Loans often close in under two weeks.

That’s personally why I like it. Underwriters nearly asking me for vials of blood (paperwork shuffling) wears me out.

One downside is that with this “DSCR” loan type, all financings must have $50K of equity left at closing. Resultantly, smaller loan amounts (minimum is $100K) would lose leverage.

This provides some remarkable new flexibility to those seeking financing.

Thought getting your money to work for you creates wealth? It doesn’t! That’s a myth. My one-hour investing video course is now 100% free: Real Estate Pays 5 Ways. For a limited time, you can learn how wealth is really created, here.