An increase in the money supply does not automatically mean that inflation will rise.

I’m using the “modern definition” of inflation here – your dollar’s decreased purchasing power rate.

Money supply can expand in a way today that it couldn’t when it was on the gold standard (pre-1971).

Velocity of money is the other substantial input into the rate of inflation.

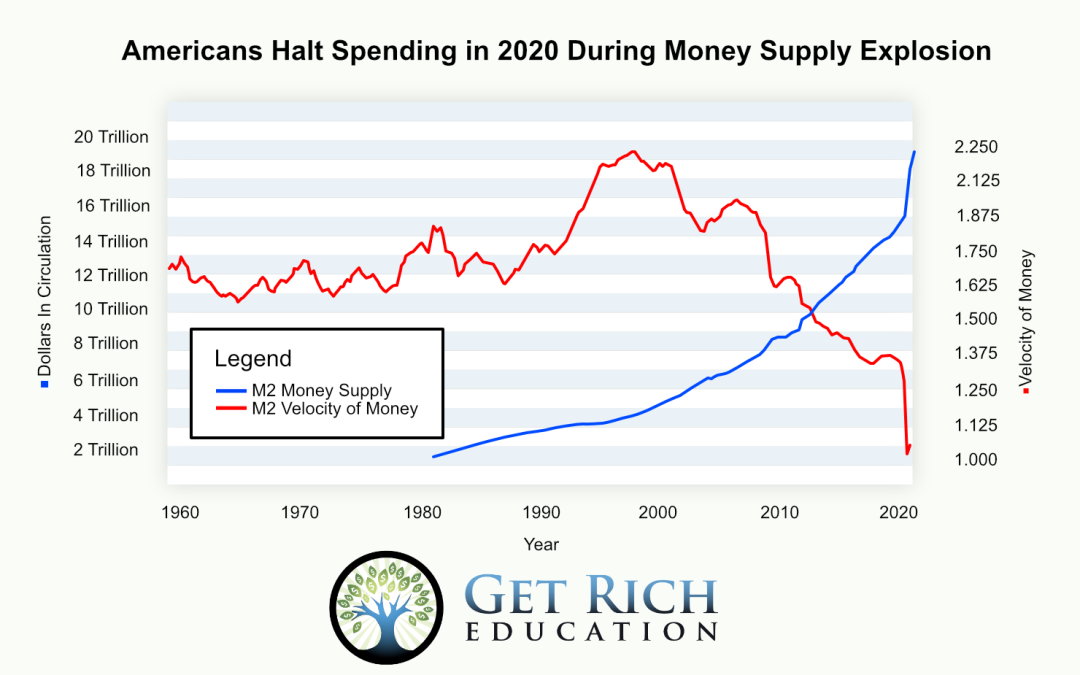

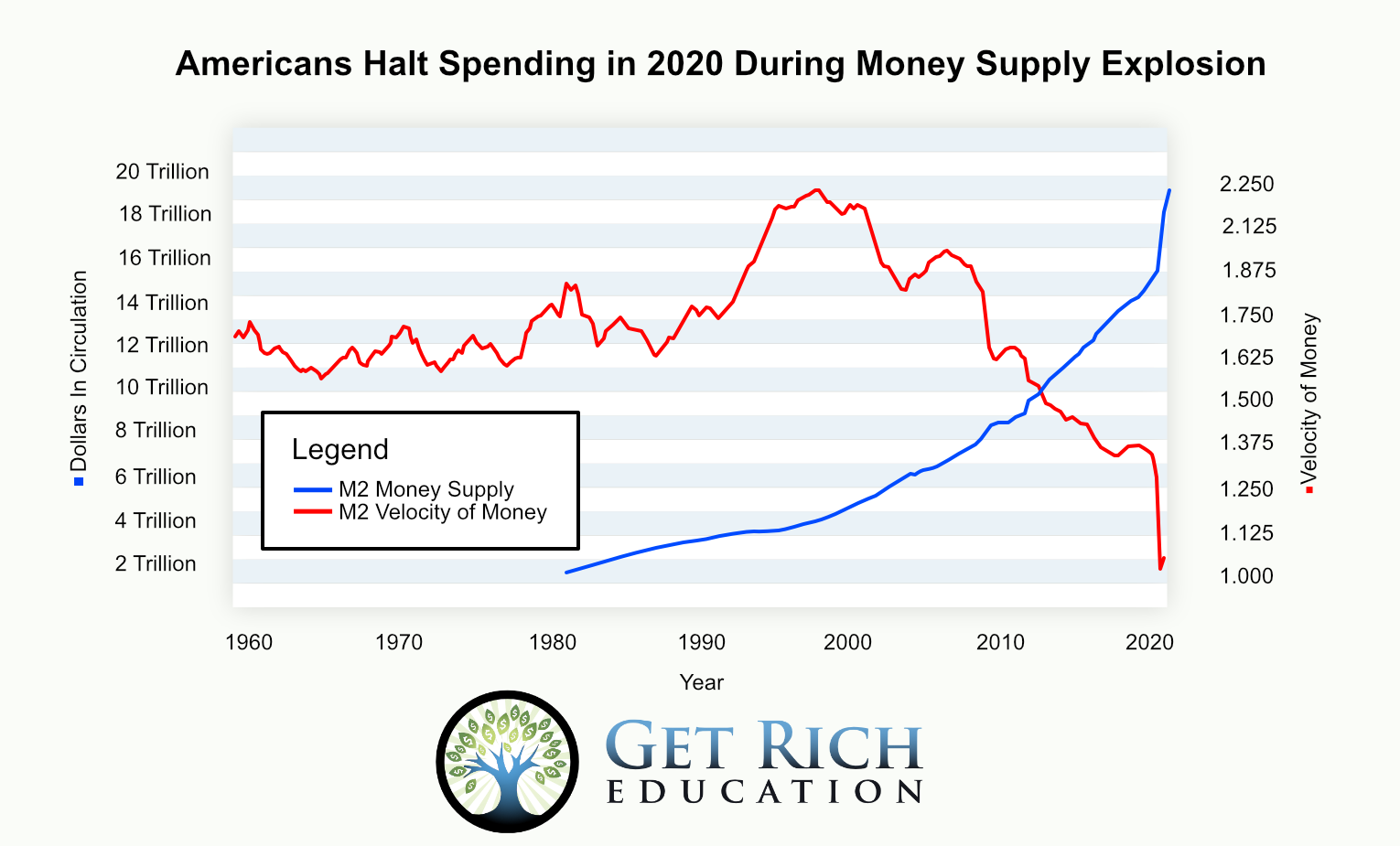

Right now, money supply is surging while velocity plummets:

This essentially plots money’s supply and demand. Velocity is like demand.

Though I’m about to get as wonky as a bespectacled professor, this is easy to understand.

Successive “money printing” cycles (The Fed called it “QE”) to pave over the 2007-2009 Great Recession did not trigger the high inflation that many had wrongly forecast.

Yes, there’s both consumer price inflation and asset price inflation.

One can think of this as the “street economy” vs. “capital asset class economy”, respectively. We’re discussing the former.

It affects your tenant more than you.

By the way, the “street thing” is the government-reported Consumer Price Index (CPI). It is updated monthly at: bls.gov/cpi It’s often around 2%.

GDP and / or Inflation = Money Supply x Velocity Of Money

What is the velocity of money then?

It’s the frequency that a unit of money is spent in an economy.

Think of velocity as the rate at which money “changes hands”. Here’s an example …

Let’s assume a tiny economy with a money supply of only $50 and two people.

Steve sells steak and Jill sells juice.

Steve starts with the $50 and buys $50 worth of juice from Jill. Jill turns around and buys $50 worth of steak from Steve.

Jill and Steve’s economy now has $100 worth of “gross domestic product” even though the money supply is only $50.

If Jill and Steve do the same two transactions every month, their “GDP” will be $1,200 per year, though the money supply is only $50.

Velocity = GDP / Money Supply or ($1,200 / $50). Velocity of money in our two-person economy is 24.

Back in the real world, higher velocity means more demand for products and services, which leads to higher prices, hence inflation.

In today’s low demand environment, it is difficult to spur velocity and inflation.

The Lesson: GDP and inflation cannot be controlled through money supply alone.

I do not expect inflation to tick up until velocity increases.

When we have high velocity, we’ll likely already have a high money supply as a complement. Then, yes, there’s potential for substantial inflation.

On our recent LinkedIn and Instagram polls, 58% and 65% of our followers, respectively, believe that inflation will exceed 5% in the next two to three years.

I think that it will take longer.

Inflation is rather hard to predict. But I swear that it’s still not as mysterious as why restaurants keep putting so much ice in cold drinks.

There’s more to it, like bank reserves and interest rates.

Low interest rates eventually encourage people to borrow, invest and spend. This leads to velocity and consequently, higher inflation. (That’s what markets have been betting on.)

Many think that a higher money supply alone pumps inflation. It does not.

Now that you better understand the velocity of money, you can anticipate when dinner parties become a post-pandemic “thing” again.

You’ll have a chance to flaunt your inflation intellect.

Thought getting your money to work for you creates wealth? It doesn’t! That’s a myth. My one-hour investing video course is now 100% free: Real Estate Pays 5 Ways. For a limited time, you can learn how wealth is really created, here.