With real estate values and rents both ballooning, some investors wonder: “Which properties still make sense to buy?”

More than a decade ago, real estate investors began to pay attention to the rent-to-value (RV) ratio.

The prevailing notion then was that achieving a monthly rent income as high as 1% of the property purchase price indicated a desirable property to buy.

For example, $1,500 of rent income on a $150,000 property is a full 1.00% RV ratio.

This was merely a rule of thumb. It was only the top line.

As your eyes scanned across property listings, this RV ratio made it easy to notice if a property was worth your time to explore further by determining the cash flow. That’s the bottom line.

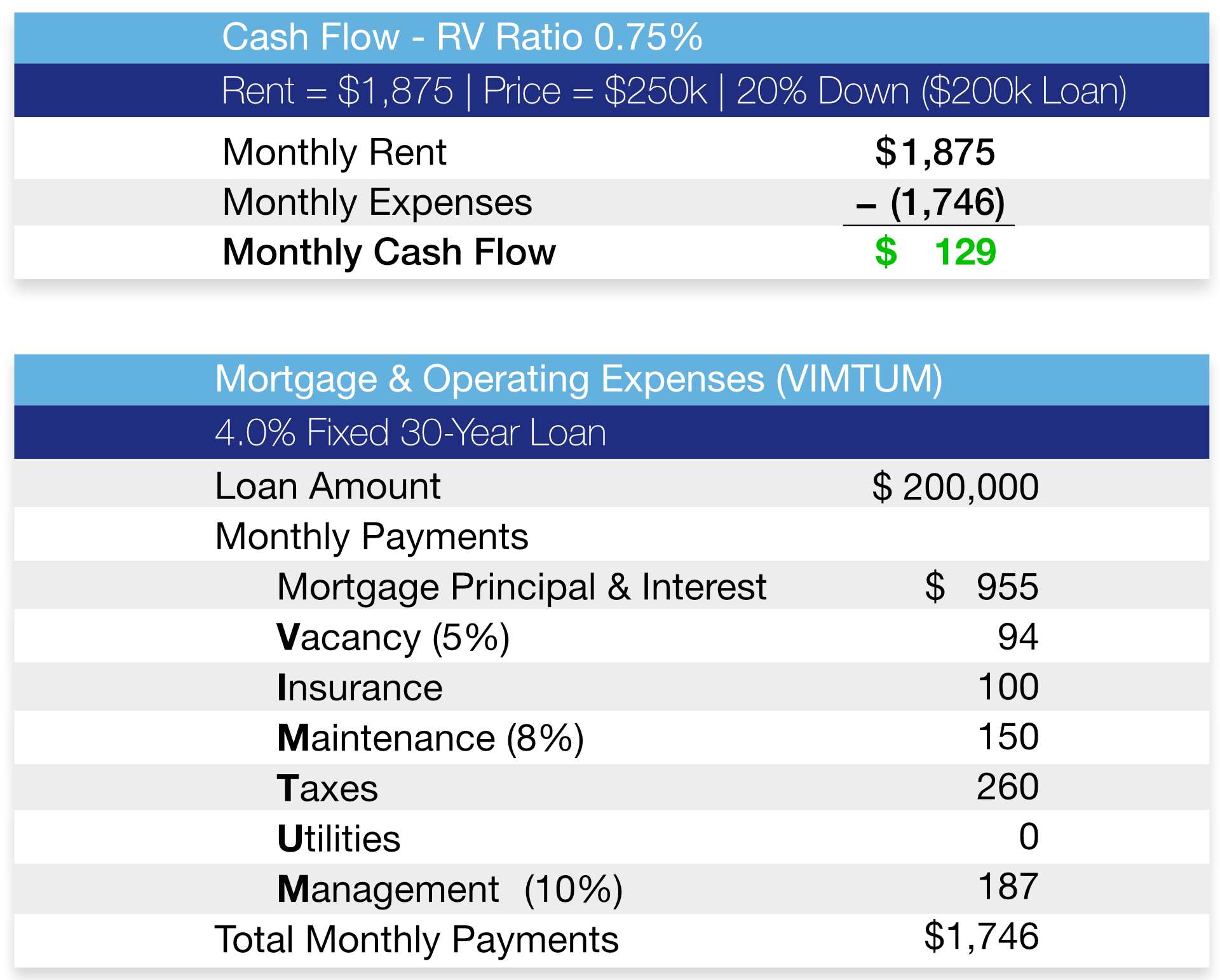

Your bottom line is rent income minus the mortgage and operating expenses: vacancy, insurance, maintenance, taxes, utilities, and management (VIMTUM). This equals cash flow.

You want positive monthly cash flow, even if it’s just a little. That’s elementary investor stuff.

Today, an RV ratio of 0.75% or even 0.66% often generates cash flow.

Before I tell you why, let me show you how. These numbers generate cash flow with a 0.75% RV ratio:

How is this possible? How are we able to generate cash flow at 0.75% RV ratio (and lower) today?

It’s instructive to remember that because the RV ratio is so simple, it excludes a lot.

Firstly, mortgage interest rates are lower than ocean floor sediment compared to ten years ago. Today’s 30-year mortgage rate is just half of 2008’s level.

The RV ratio does not account for this. 80% of your property cost is in the financing.

Home prices and rents are at historic highs. Mortgage interest rates are still near historic lows.

Secondly, there are more build-to-rent properties today. Yes, these rental properties are brand new construction on “Day 1”. What does this have to do with the RV ratio?

You didn’t see many new-build properties ten years ago. Today, they almost seem more common than renovated income properties.

New-builds often have lower: vacancy rates, insurance premiums, and maintenance costs. RVs do not reflect any of these three VIMTUMs.

They only become apparent when you crunch the cash flow.

Thirdly, regarding both new-build and renovated income properties, GRE’s formula is often to have you sell and trade up for more property within ~8 years, depending on appreciation rates.

This equity harvesting keeps your leverage position high.

Avoiding long holds also hedges you from longer-term maintenance and CapEx layout.

For example, you’ll typically avoid having to replace a gas water heater, which has a life expectancy of around ten years. (Count on having to do it sometimes though.)

This is also why a GRE follower is more profitable than other investors over the long run.

(If you’ve got a property that’s a star performer, you may want to hold onto it and try a tax-free cash-out refinance instead.)

These are three big reasons why RV ratios substantially lower than a full 1% work today, perhaps as low as 2/3rd of 1%.

This is real.

Buying because you believe that rents or prices will appreciate in the future is speculative (though you might be right).

Of course, a property with a lower RV ratio might be better than a high one. How?

If your lower RV property is in a thriving market with a communicative property manager.

The RV matters, but because it’s so simple, it’s only a starting point in making a purchase decision.

You can get started with income property purchases from our provider network at: GREturnkey.com.

Thought getting your money to work for you creates wealth? It doesn’t! That’s a myth. My one-hour investing video course is now 100% free: Real Estate Pays 5 Ways. For a limited time, you can learn how wealth is really created, here.