Want to be persona non grata at your next Zoom party? Announce to everyone that your big ambition includes $10 million in debt.

When conventional financial advisors hear the word “debt”, they rapidly start dishing out more warnings than Dr. Fauci on COVID-19.

I tell you why to consider more debt. It can put one on a road to becoming an autodidact. (Say what?)

To the uninitiated, this could be the greatest abundance mindset lesson of a lifetime. I teach it.

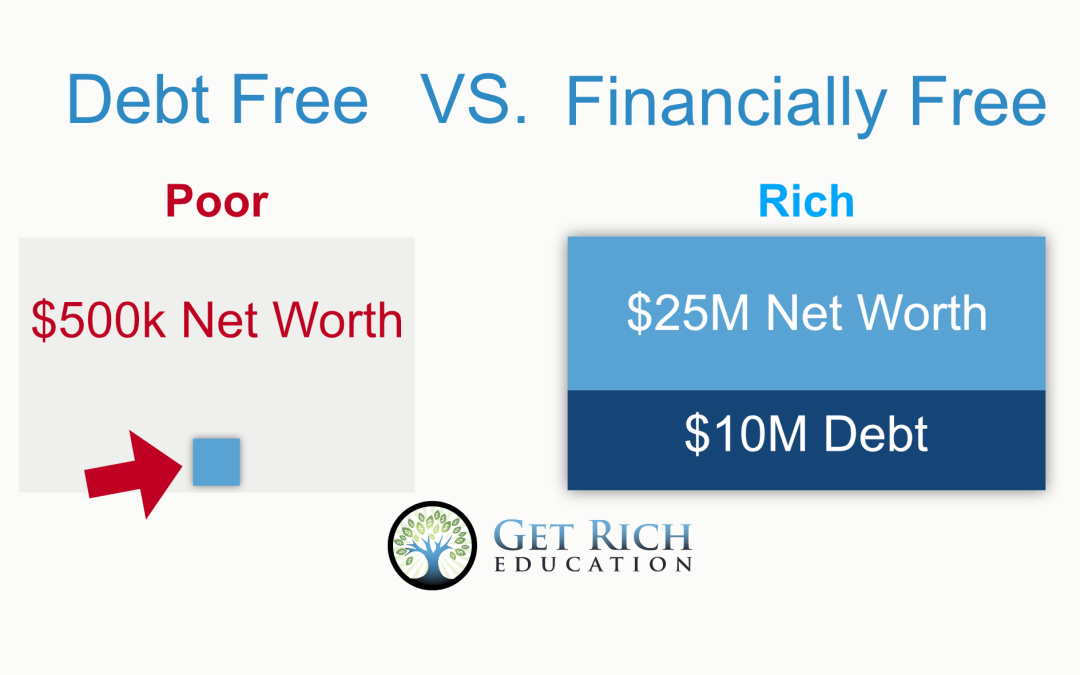

Imagine a man on the street. This guy is $10 million in debt … and that means he’s probably wealthy.

The biggest losers are the ones that eventually win it all.

If you have a fear of anything, it should be a fear of being normal.

Here is the lesson … or click the video below:

To the debt decamillionaire, the $300K annual inflation tailwind is mere background noise to the windfall of leveraged appreciation.

The 10% property appreciation (experienced in many markets recently) is a 40% return to the prudent borrower …

… leveraged 4:1 with 25% equity and 75% debt.

Without debt, a 10% return is … well, just a 10% return.

This is how you expand your means. Depending on your point of view, debtors look like either big losers or big winners.

When you have an abundance mindset, you see debt as a tool. Debt is a powerful lever.

Most people stay in the middle. It’s safer. They stay small to fit in. Going big is scary. But fear is not the best of who you are.

The key lesson is my go-to axiom: Don’t live below your means. Expand your means.

Early in life, I think that living within your means makes sense.

But permanently living below your means is the wrong playbook for a life well-lived. You’re cheating yourself.

That’s like Barry Bonds bunting … Tom Brady retiring after college … Beyoncé quitting after Destiny’s Child … flying to moon without walking around … or aggressively negotiating a pay cut from your boss.

Left unchecked, delayed gratification becomes denied gratification.

Winners avoid normalcy. Long-term, leverage makes you more of who you want to be.

Always remember: Don’t live below your means. Expand your means.

Thought getting your money to work for you creates wealth? It doesn’t! That’s a myth. My one-hour investing video course is now 100% free: Real Estate Pays 5 Ways. For a limited time, you can learn how wealth is really created, here.