Though it’s not quite America’s favorite spectator sport, the new CPI inflation reading drops next Wednesday. The BLS play-by-play is slower than the NFL’s. But I’ll cover it like Al Michaels did the Super Bowl.

Let’s compare the 2004 rental market to 2022’s. I learned a lesson here.

Eighteen years ago, in 2004, I was a new real estate investor. Tenant stays in my fourplex seemed unusually short.

Increasingly, renters said: “I’m out.”

Tenants vacated my property and I had to find new renters. These evacuees had an easy time buying an entry-level home. It was often a condo.

Was this all because I lived on the premises and played the Wu-Tang Clan too loudly?

No.

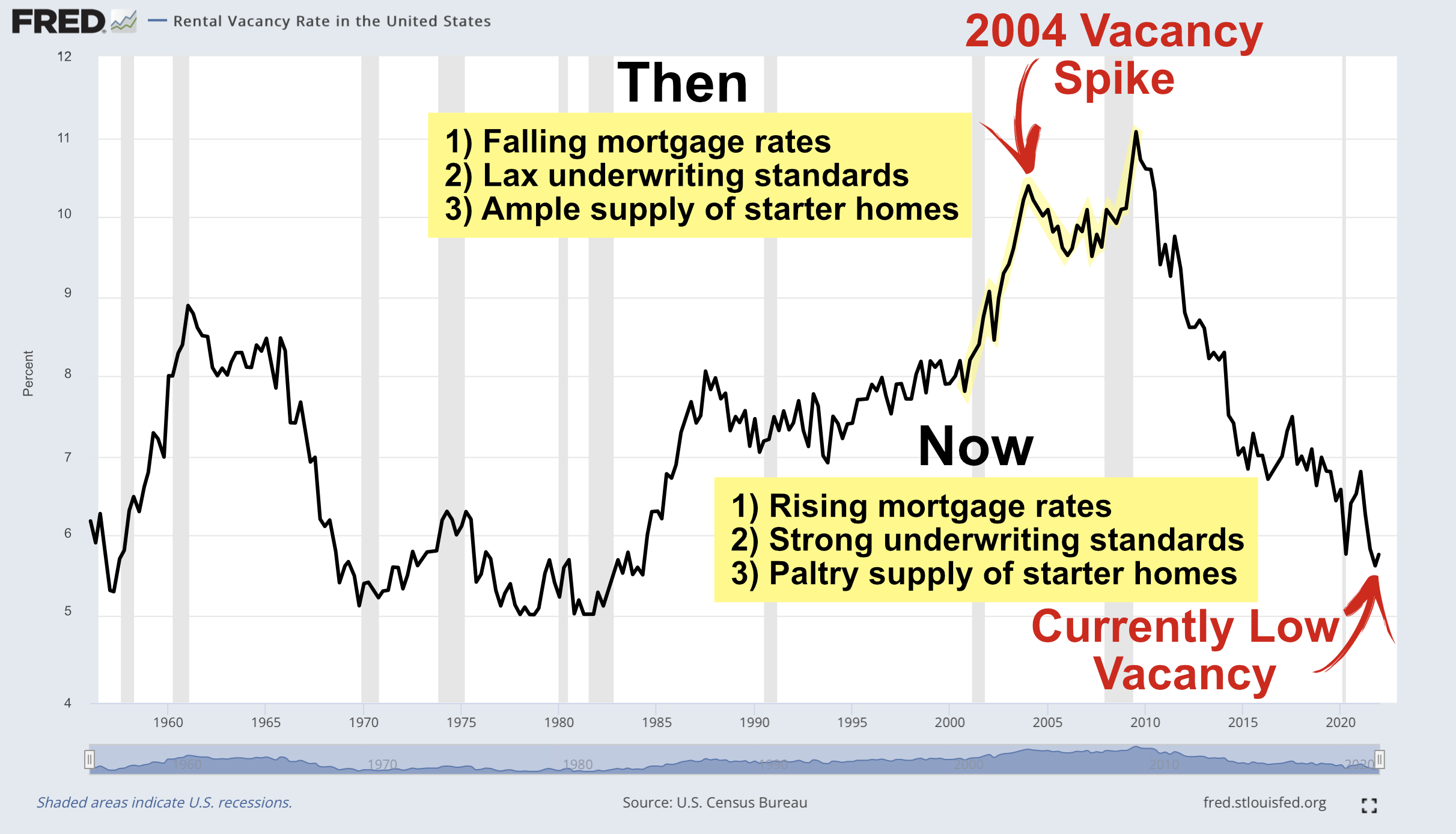

This happened for three main reasons, which I didn’t understand until a few years later. Peering back across the 2004 housing landscape:

1) Mortgage rates were falling. This increased homebuyer affordability.

2) Tenants left due to ample housing supply. There were tons of affordable, suitable first-time buyer homes to move into.

That almost seems hard to believe today, doesn’t it?

3) The really big reason for the renter exodus is that virtually anyone could qualify for a loan. Mortgage underwriting standards were irresponsibly lax.

You could qualify at 100% LTV even if you had zero income, no job, and no assets. Loans were way too easy to get for my former renters-turned-starter-homebuyers.

Alive + Breathing = 2004 Qualified Homebuyer

Take a look at what this did to the national rental vacancy rate then,

LToday, all three of these criteria are completely flip-flopped.

1) Mortgage rates have risen since last year. This harms the budget-sensitive first-time homebuyer most.

2) There’s an historic undersupply of homes, especially starter homes.

Tenants cannot flee to become homeowners because often, there’s nothing to move into.

In many markets, the queue to view a newly-listed starter home is still longer than the Dunkin’ line at LaGuardia.

Rental bidding wars have broken out in some places.

Few buyers win.

3) Loan qualification standards are tougher than leather sandwiched between Kevlar.

As you saw in the chart above, this has created a low rental vacancy rate that should keep trending downward.

They’re the three big reasons why your rents keep rising faster than historic norms.

August 9th, 2022 will be the 20-year anniversary of buying my first rental property. Over the last twenty years:

- How it started → Advantage Renters

- How it’s going → Advantage Landlords

Thought getting your money to work for you creates wealth? It doesn’t! That’s a myth. My one-hour investing video course is now 100% free: Real Estate Pays 5 Ways. For a limited time, you can learn how wealth is really created, here.