The main reason that the real estate market has shifted is decreased home affordability.

Demand has waned, but just slightly. The number of days on market demonstrates that housing demand still vastly exceeds supply.

How you shift with the market depends on how you’re positioned.

Let’s see how today’s trends of: high inflation, higher housing prices, spiking rents, and hiked mortgage interest rates affect three groups:

- Wannabe first-time homebuyers

- Existing homeowners

- Opportunists looking to invest

If there’s one group that feels like this shift is a bunch of bullshift (had to), it’s wannabe first-time homebuyers.

Both soaring interest rates and higher house prices have teamed up for a real affordability hit.

A good rule of thumb to keep in mind is that every 1% interest rate increase dents affordability by about 12%.

Now here’s how this looks when it’s coupled with appreciating home prices. With an 80% loan:

- One year ago, a $360,000 home with a 3% mortgage rate had a monthly payment of $1,214.

- Today, that same home could cost $420,000. At a 5.75% rate, the payment is $1,961.

Yet today’s higher payment could actually look attractive by year-end.

That’s because increases in both home prices and mortgage rates should continue, albeit at a slower rate.

In fact, due to the increases, I was just on TV (video clip here) advising that a homebuyer target a property 10% less than what one can afford.

I’m not a “live small, make a budget” guy. This strategy hedges against the life upheaval of a purchase cancellation.

People priced out of homeownership have to live somewhere. Increasingly, they must go into the renter pool, increasing its size.

This is a huge contributor to soaring rents.

The second group experiencing the shift is existing homeowners that have accumulated equity.

Besides the fact that the return from home equity is always zero, high inflation is now debasing your equity faster too.

Inflation debases debt at the same rate.

From this perspective, it’s wiser to have less equity and more debt.

But now there’s a problem.

A year ago, you might do a cash-out refinance with your entire mortgage balance because you could lock it all in with a 3% or 4% mortgage rate.

However, if you do that at today, you’d lose your subterranean rate.

But there’s a way to have it all.

You can often keep your cheap loan in place and access the equity with a Home Equity Line Of Credit (HELOC) as a second mortgage.

Personally, it’s a strategy that I’ve employed.

Alternatively, you can refinance your property with, say, a 5-year adjustable rate mortgage (ARM).

Many people summarily dismiss ARMs. But note that:

- Today’s 5-year ARM rate is 1.5% lower than the 30-year FRM.

- Your ARM rate stays fixed for the first five years before adjusting.

For long-term holds, ARMs are a riskier choice. But for holds of, say, 7 years or less, they can make a lot of sense.

The third group responding to the shift is opportunists looking to invest new dollars.

You’re looking to protect what you have while achieving growth at the same time.

By buying good quality income property with a loan, you expect to benefit from ever-higher home prices (though it cannot be counted on), rents now soaring at 26%, and inflation-profiting on the debt.

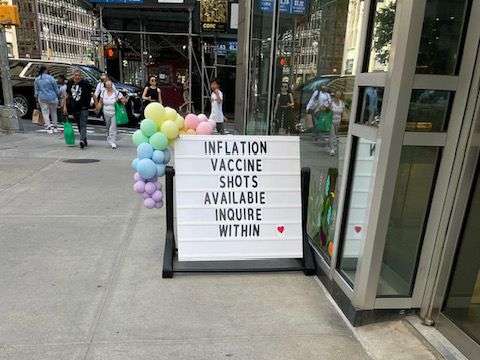

Could we then say that buying entry-level rental property this way is like getting an inflation vaccine?

This “inflation vaccine” has nothing to do with the CDC or Dr. Anthony Fauci. Rather, it’s about borrowing dollars.

Over the last two years, gold and cryptocurrency speculators thought that they were “vaccinating” themselves against inflation. But those prices have gone either down or nowhere.

Fixed rate debt on an income property means that you beat inflation directly. You don’t have to speculate.

Your principal and interest payment stays locked in at a time that rents are surging fast and your debt gets debased from high inflation.

You’re serving the swelling category of renters that continue to become priced out of an increasingly exclusive homeowner market.

Thought getting your money to work for you creates wealth? It doesn’t! That’s a myth. My one-hour investing video course is now 100% free: Real Estate Pays 5 Ways. For a limited time, you can learn how wealth is really created, here.