The world suddenly feels unusually… futuristic. At the rate AI apps like ChatGPT and Lensa are trending, when will using my mind and fingertips on this keyboard to write these words beneath that real headshot be passé? We discuss metaverse real estate on this GRE Podcast. Still using my real voice over there, btw.

This whole week is interesting.

December 13, 2022, a new inflation reading released showing 7.1%.

December 14, 2022, Jerome Powell made another interest rate increase, this time 50 basis-points.

Real estate is such a segmented market that some experts don’t even consider it to be an asset class.

Often, that’s why housing data cannot be broad brush-stroked.

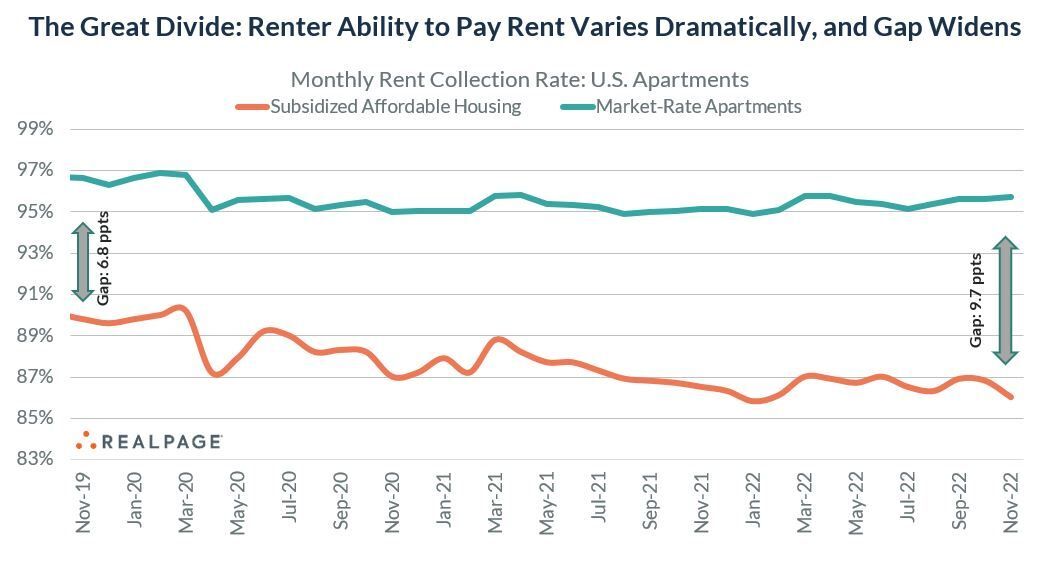

Since 2019, the ability for your tenant to pay rent has become more dependent on the class of housing you provide.

In market-rate apartments (likely SFRs too), these higher income renters keep paying the rent. In fact, that rate has even improved recently, inching toward a 96% collection rate.

Conversely, rent-restricted, subsidized housing attracts lower-income tenants. They’re struggling to pay rent. The rate keeps slipping, now at 86%.

Why the widening gap?

High inflation hits low income residents hardest.

If the true inflation rate for groceries is, say, 20%, that leaves struggling households with less money to pay rent.

Market-rate renters often have mid-to-high incomes. They’re less affected by inflation. They’re also more likely to have wages that keep pace with inflation.

Bottom line? The most economically resilient income properties are often:

- Market-rate units.

- 1-4 unit properties and better apartments. They generally attract higher income tenants.

- Properties just below the area’s median housing price. Avoid the lowest tiers.

Thought getting your money to work for you creates wealth? It doesn’t! That’s a myth. My one-hour investing video course is now 100% free: Real Estate Pays 5 Ways. For a limited time, you can learn how wealth is really created, here.

Hi Keith and Team,

Long-time listener, reader, and viewer here. I’m a “small time” stock and RE investor looking to add 4 doors to my portfolio and get paid 5 ways. Ready to deploy about $100k cash and get leveraged.

Can you talk to me briefly about the pros/cons of owning one fourplex vs. four single family homes? For example, what do you see as the plusses and minuses of buying one fourplex in Memphis as compared to buying 4 separate SFRs in Memphis, Little Rock, Detroit, and Florida?

Additionally, hoping you might tell me a little about the turnkey market in Buffalo, NY. Taxes too high in NY or something else that keeps GRE away?

Thanks!

Tyler Morningstar